You could report any punitive harm award obtained in a mesothelioma settlement as Different Earnings on line 21 of Type 1040 Schedule 1 come tax time. When a lawsuit is first filed the sufferer and their attorneys will request a sure sum of money based mostly on the victims bills ache and struggling and different components.

Mesothelioma Lawsuit Settlements Taxable Or Not In 2020 Mesothelioma In Legislation Suite Punitive Damages

Theyre related solely for mesothelioma lawsuits and verdicts.

Is a mesothelioma settlement taxable. Common Mesothelioma Settlements On common cash that you just win in a mesothelioma settlement just isn’t taxable whether it is within the type of basic damages or particular damages. Mesothelioma settlement quantities range relying on how when and the place an individual was uncovered to asbestos together with different components. Asbestos declare payouts for medical bills are typically not taxable.

This information presents perception into kinds of settlements together with whether or not mesothelioma settlements are taxable. An skilled mesothelioma lawyer can clarify which a part of your mesothelioma settlement is taken into account taxable revenue and which half just isn’t. In line with the IRS punitive damages are taxable.

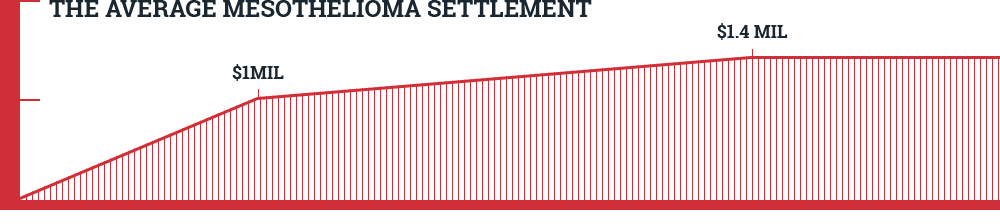

Mesothelioma settlements could also be taxable relying on the kind of payout. Mesothelioma awards could cowl medical bills misplaced wages or punish the defendants punitive damages. Usually in accordance with a 2016 Mealeys Litigation Report the common trial award is 24 million and the common settlement award is between 1 million and 14 million.

For instance cash awarded to pay for a victims accidents or medical payments just isn’t usually taxed nonetheless punitive damages designed to punish these being sued are often taxable. 1040 Schedule 1 even when the punitive damages have been obtained in a settlement for private bodily accidents or bodily illness. Nevertheless monetary compensation obtained for misplaced wages could also be taxable.

In a mesothelioma lawsuit towards an asbestos firm for instance the plaintiff could obtain an award for the companys negligence that led to asbestos publicity and an eventual analysis. If You Deducted Medical Bills Your Settlement Is Taxable. Basically compensation for misplaced wages and emotional misery is taxable however compensation to cowl medical bills just isn’t taxable.

There are additionally situations wherein a part of the settlement could also be taxable. Get Your Mesothelioma Settlement Now. Final however not least any awards for misplaced wages are taxable.

Are Mesothelioma Settlements Taxable Earnings. Nearly all of mesothelioma settlements are freed from tax penalties. In lots of private harm instances all the award or settlement payout in a mesothelioma case is tax-free below the Equity in Asbestos Damage Decision Act of 2005 Senate Report 109-97 and the Equity in Asbestos Damage Decision Act.

Nevertheless settlements assure compensation whereas verdicts introduce an excessive amount of danger. For individuals who are distressed as a result of their liked one was identified with mesothelioma or died as a consequence of the sickness it might or will not be taxable. Mesothelioma Settlement Quantities.

A mesothelioma legal professional can clarify whether or not your settlement payout is taxed. Basically most if not all the compensation obtained via a mesothelioma settlement just isn’t taxable. Punitive damages are taxable and ought to be reported as Different Earnings on line 21 of Type.

There are additionally situations wherein a part of the settlement could also be taxable. Thats as a result of part 104 the IRS tax code doesn’t tax compensation awarded in direct connection to private accidents or illness. The final rule of taxability for quantities obtained from settlement of lawsuits and different authorized cures is Inner Income Code IRC Part 61 that states all revenue is taxable from no matter supply derived except exempted by one other part of the code.

Mesothelioma settlements and verdicts could offer you a various quantity of compensation. Usually the financial compensation you acquire in a mesothelioma case for emotional distress personal accidents and medical payments aren t taxable on the state or federal diploma. Mesothelioma victims could must pay taxes on the cash they obtain from a settlement.

Typically the quantity gained from mesothelioma settlements varies based mostly on the components beneath. Some settlement recipients could have to make estimated tax funds in the event that they count on their tax to be 1000 or extra after. Essentially the most sophisticated problem really lies within the emotional misery factor.

Nearly all of mesothelioma settlements are freed from tax penalties The taxation on mesothelioma settlements is sort of complicated and whether or not the sum of cash you obtain following a private harm lawsuit is taxable will principally rely on the kind of compensation you’re awarded. Typically punitive damages and misplaced wages are the 2 taxable components in mesothelioma compensation they usually arent relevant to mesothelioma settlements or belief fund claims.