It relies upon upon the sort of compensation that’s awarded from a verdict or a mesothelioma settlement. If you’re submitting for wrongful termination and dropping your job means you grew to become emotionally distressed you’ll have to be taxed.

Do You Have To Pay Taxes On A Wrongful Dying Settlement Wrongful Dying Legal professionals Ben Crump

Do You Have To Pay Taxes On A Wrongful Dying Settlement Wrongful Dying Legal professionals Ben Crump

Mesothelioma lawsuits normally fall into the class of private harm circumstances so most individuals shall be awarded each common and particular damages as compensation which they won’t need to pay taxes for.

Do you need to pay taxes on a mesothelioma settlement. In case your settlement is meant to compensate you for misplaced wages you’ll have to pay no less than a portion of the taxes due on the quantity. Don’t embody the settlement proceeds in your earnings. What quantity of taxes do you pay on a mesothelioma lawsuit.

This implies you do not need to pay federal or state taxes on them. Settlement taxes generally. Discover one of the best ones close to you.

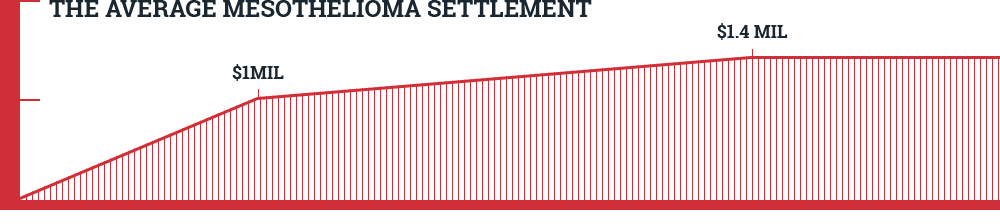

Every step within the authorized course of impacts mesothelioma settlement time frames and when you could obtain compensation. Sometimes in response to a 2016 Mealeys Litigation Report the common trial award is 24 million and the common. Due to this fact taxes usually are not required since these sorts of settlements are at all times free from tax penalties.

Nevertheless there are some settlements the place this isnt the case together with private harm and wrongful demise settlements these usually are not taxed as earnings. Nevertheless victims of asbestos publicity could typically obtain a type of compensation which is taxable. Be taught extra about every step within the settlement course of beneath.

If the settlement was offered that can assist you cowl the price of your medical bills and the psychological anguish you endured throughout your sickness the taxable quantity of your settlement shall be a lot much less. If you’re additionally receiving Supplemental Safety Revenue SSI or Social Safety Incapacity Insurance coverage SSDI advantages a portion of your employees compensation could also be taxable earnings. Offsets and Exceptions to Tax Exemptions.

A mesothelioma settlement is a sum of cash that has been accepted by each events victims and the at-fault firms instead of a trial. Probably the most difficult challenge truly lies within the emotional misery component. Step one in reaching a mesothelioma settlement is to file a lawsuit.

Most asbestos victims are eligible concerning common and particular damages with regards to monetary compensation. BUT Should you obtain a settlement for private bodily accidents or bodily illness you need to embody in earnings that portion of the settlement that’s for medical bills you deducted in any prior years to the extent the deductions offered a tax profit. So if you happen to acquired a mesothelioma prognosis and this left you distressed as it could you wouldn’t need to pay tax on it.

Paying tax on settlements The legislation views most authorized settlements as a type of earnings to the recipient and most settlement taxes fall beneath the class of earnings taxes. You’ll quickly have the ability to acquire simply compensation in your mesothelioma medical payments misplaced earnings and ache and struggling. Inform us what you suppose Did this text assist you to.

Nevertheless there’s one exception. On common cash that you just win in a mesothelioma settlement shouldn’t be taxable whether it is within the type of common damages or particular damages. The mesothelioma settlements which might be particularly for private harm claims – usually are not taxable and don’t want reported on kind 1041.

When you’ve got reached an asbestos most cancers settlement with the corporate or firms that uncovered you to this lethal human carcinogen you most likely are relieved. Join With a Legislation Agency and Collect. Avvo has 97 of all attorneys within the US.

Normally compensation for common or particular damages shouldn’t be taxable however compensation for misplaced wages and punitive damages is taxable. In most situations the reply is not any you wont must pay taxes on any private harm settlement you obtain no less than to the extent that the quantity you get is supposed to compensate you for accidents suffered. You might be completely right.

Nevertheless typically settling an asbestos declare is essentially the most simple half when there’s a Medicare lien. The settlement can be utilized to pay for medical and family bills and gives long-term monetary stability for the sufferer and relations. Should you acquired reporting types from payers – similar to 1099MISC – it’s worthwhile to contact payers and ask for corrections.

The taxation on Mesothelioma Settlements nonetheless is determined by the kind of compensation you’re awarded. Mesothelioma Settlement Time Frames and Lawsuit Payouts.