Even in private damage lawsuits which might be sometimes thought of exempt there could also be some situations the place plaintiffs are required to say a part of their settlement proceeds. Usually parts of settlements attributable to ones revenue like severance pay again pay or entrance pay are thought of taxable as a result of it’s nonetheless extraordinary revenue.

Are Mesothelioma Settlements Taxable Elg Regulation

Are Mesothelioma Settlements Taxable Elg Regulation

Curiosity on any settlement is usually taxable as Curiosity Revenue and must be reported on line 2b of Kind 1040.

Are mesothelioma settlements taxable revenue. Punitive damages are taxable and must be reported as Different Revenue on line 21 of Kind. He lately acquired 40K because of a lawsuit towards asbestos mfgrs on account of his mesothelioma. Are Mesothelioma Settlements Taxable Revenue.

1040 Schedule 1 even when the punitive damages had been acquired in a settlement for private bodily accidents or. Is that this cash thought of taxabl. Usually punitive damages and misplaced wages are the 2 taxable components in mesothelioma compensation they usually arent relevant to mesothelioma settlements or belief fund claims.

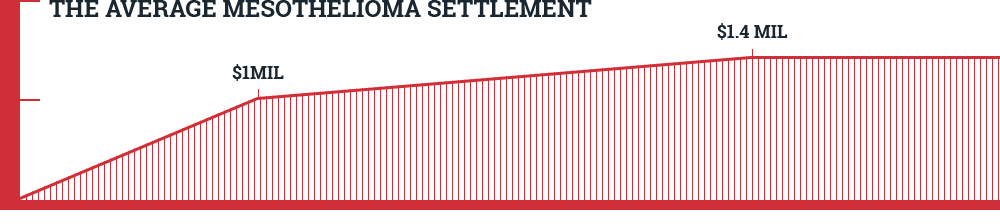

Torts are authorized processes looking for compensation for harm attributable to wrongful acts. Sometimes in accordance with a 2016 Mealeys Litigation Report the common trial award is 24 million and the common settlement award is between 1 million and 14 million. In lots of private damage circumstances the complete award or settlement payout in a mesothelioma case is tax-free underneath the Equity in Asbestos Harm Decision Act of 2005 Senate Report 109-97 and the Equity in Asbestos Harm Decision Act.

When an asbestos lawsuit is settled victims are normally awarded monetary compensation for certainly one of two causes which have an effect on whether or not it. Usually compensation for misplaced wages and emotional misery is taxable however compensation to cowl medical bills isn’t taxable. The common mesothelioma settlement is between 1 million and 14 million and sometimes paid by a number of defendants.

Common Mesothelioma Settlements On common cash that you just win in a mesothelioma settlement isn’t taxable whether it is within the type of common damages or particular damages. Asbestos exposure-related illness litigation is the American authorized techniques longest working tort and theres no finish in sight. If You Deducted Medical Bills Your Settlement Is Taxable.

Whether or not mesothelioma settlement cash is taxable will depend on the kinds of damages awarded. An skilled mesothelioma lawyer can clarify which a part of your mesothelioma settlement is taken into account taxable revenue and which half isn’t. Be taught extra about mesothelioma settlements and the way these are negotiated.

A mesothelioma lawyer can clarify whether or not your settlement payout is taxed. Theyre related solely for mesothelioma lawsuits and verdicts. Fortuitously whereas taxation on settlement is advanced most of those settlements are freed from tax to a sure diploma.

Usually wrongful loss of life and survivors actions settlements are each freed from tax. Are Mesothelioma Settlements Taxable Revenue. You should report any punitive harm award acquired in a mesothelioma settlement as Different Revenue on line 21 of Kind 1040 Schedule 1 come tax time.

Thats as a result of part 104 the IRS tax code doesn’t tax compensation awarded in direct connection to non-public accidents or illness. The vast majority of mesothelioma settlements are freed from tax penalties The taxation on mesothelioma settlements is sort of advanced and whether or not the sum of cash you obtain following a private damage lawsuit is taxable will largely depend upon the kind of compensation you’re awarded. Are Mesothelioma Settlements Taxable Revenue.

Usually most if not the entire compensation acquired by a mesothelioma settlement isn’t taxable. This information provides perception into kinds of settlements together with whether or not mesothelioma settlements are taxable. Mesothelioma awards might cowl medical bills misplaced wages or punish the defendants punitive damages.

Asbestos declare payouts for medical bills are usually not taxable. A few of the cash awarded in a mesothelioma settlement is taken into account taxable revenue whereas a few of it’s not. Nevertheless each case is exclusive.

Mesothelioma settlements could also be taxable relying on the kind of payout. 82 and 85 yr previous married couple have a complete SS revenue of 1400mth. In accordance with the IRS punitive damages are taxable.